Which Type of Life Insurance Is Perfect for You?

By now, a fair number of Canadians have started realizing that life insurance is necessary for the protection of their family’s financial security. But how many of us know which type of insurance to buy? Not many, I suppose. This is why, today I will discuss the various types and help you find out which one is the best for you.

Whether you are planning to buy a house, or planning to invest all your savings in a new business with a partner, or planning to have a baby, your responsibility increases by all means. in each case another person(s) will be dependent on you for financial stability.

Life insurance in all these cases will become more of a necessity than a choice. Life insurance lets you protect the financial security of your loved ones by providing them with tax-free cash benefit when are no more. Especially because you won’t be around them forever to support them, you must ensure that their expenses are taken care of in the best possible manner. and for that, you must decide which is the best type of life insurance for you.

What Type of Life Insurance Is the Best for You?

When people talk of life insurance, they somehow think of it as only one kind; one kind that suits everyone. The kind your father has, may be the best for him, but you may need more; what your best friend just bought may not be the best suited for you.

everyone has a different personal situation. So, there is no one type of life insurance that fits all. your personal needs and your present financial situation majorly decide which kind you will need. In fact, there could be more than one right type for you depending on your age, sex, financial position, family responsibilities, etc.

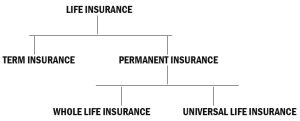

Types of Life Insurance

The last two are in fact types of Permanent Life Insurance

Term Life Insurance

What does it offer?

Term life insurance offers flexible, temporary but renewable life protection to enable you to support those who depend on you even after your death. It provides you the flexibility if you wish to convert the policy to permanent, participating, or universal life insurance.

When can it be claimed?

in the event if the insured person’s death (before the term expires)

How does it pay you?

A tax-free cash payment is made to your beneficiary.

What are the payment terms?

It tends to less expensive initially. and the cost doesn’t increase during the span of the term. However, when you renew the term the cost will increase every time.

Who benefits the most?

- Ones who have a young family

- Ones who have a mortgage

- Ones who need the most affordable insurance option in the short term

- Ones who own a business and need to protect it for a limited time

Permanent Life Insurance

What does it offer?

Permanent life insurance offers to cover you with lifelong protection in the event of your death. It also offers tax-preferred cash value growth.

When can it be claimed?

At the time of your death it must be claimed by your beneficiary.

How does it pay you?

A tax-free cash payment will be paid to your beneficiary.

What are the payment terms?

Whatever premium you pay when you buy it first, is fixed for life. A permanent plans lets you pay a guaranteed amount for a stipulated period of time and then nothing for the rest of your life.

Who benefits the most?

- Ones looking for affordable and guaranteed lifetime coverage and death benefit

- Ones who’d like guaranteed cash value

- One looking for fixed premiums that don’t increase

Participating Life Insurance:

What does it offer?

Participating life insurance gives you guaranteed lifetime protection. It also offers tax-preferred cash value growth as well as death benefit growth. You may also receive dividends which can help you increase coverage. Alternatively these dividends can also be used to reduce premiums, leave as it is deposit so as to earn interest, or even receive as cash.

When can it be claimed?

Your beneficiary will receive the claim whenever you die. there is no time limit.

How does it pay you?

A tax-free cash payment is what your beneficiary will receive.

What are the payment terms?

Whatever your first premium is, it remains the same for life. Some plans even allow you to pay only for a few years and no thereafter.

Who benefits the most?

- Ones who wish to get a guaranteed coverage along with a fixed cost

- Ones who want to increase the death benefit over time so as to keep up with increasing expenses.

- Ones who have maximized their RRSP and TFSA contributions, and thus want a strategy that not only increases non-registered investments but does so in a tax-efficient manner.

- Business owner who are looking for a tax-efficient way to insure business value.

Universal Life Insurance:

What does it offer?

Universal life insurance offers guaranteed lifetime protection as well as options for tax-preferred investment. You can also get tax-preferred cash value along with death benefit growth.

When can it be claimed?

your beneficiary gets the claim when you die. There’s no time limit.

How does it pay you?

A tax-free cash payment is granted to your beneficiary.

What are the payment terms?

You can choose the amount you want to payas long as it is enough to keep the policy active. If you are paying over and above the premium of insurance, it is transferred into a tax-preferred account that is invested on the basis of the options you choose.

Who is permanent life insurance for?

- Ones who want lifetime insurance coverage that is flexible and also offers the opportunity for tax- preferred savings

- Ones who have maximized their RRSP and TFSA contributions, and now want to grow your non-registered investments through a tax-efficient strategy

- Ones who like hands-on approach for their investments

- You’re a business owner searching for tax-efficient ways to protect your business value.

So, which one is the best for you? You will need to decide, given your personal requirements. Nevertheless, a professional insurance advisor can be of much help.